How to Choose a Surveyor When Buying a Property in England or Wales

What should I be looking for when choosing a surveyor?

Introduction:

Buying a property is a significant investment, and ensuring you're making an informed decision is crucial. One essential step in the home-buying process is getting a surveyor to assess the property's condition. A surveyor's expertise can help you identify potential issues, negotiate the right price, and make well-informed choices. In this article, we'll answer some common questions about surveyors and guide you on finding the right professional for your needs.

1. Is it worth getting a surveyor?

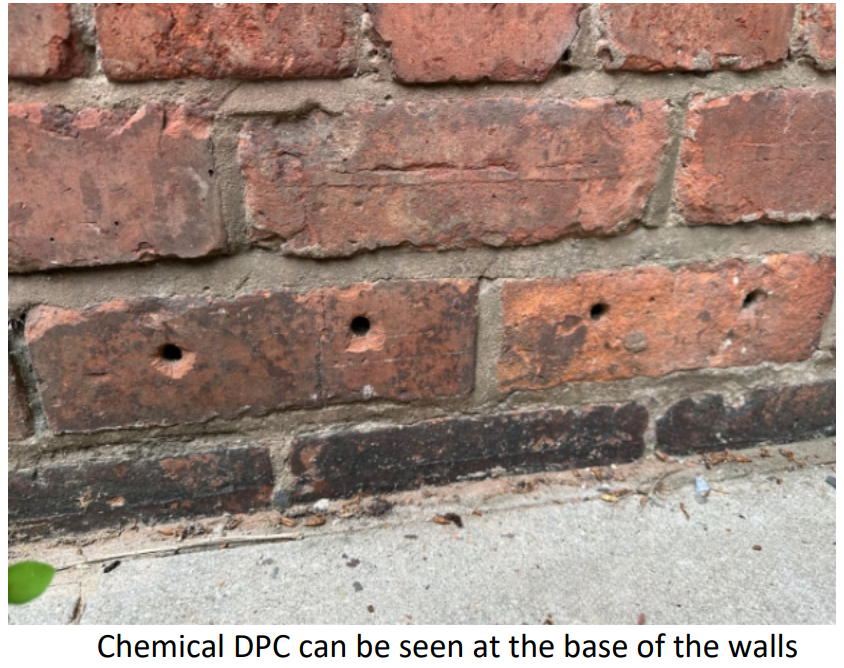

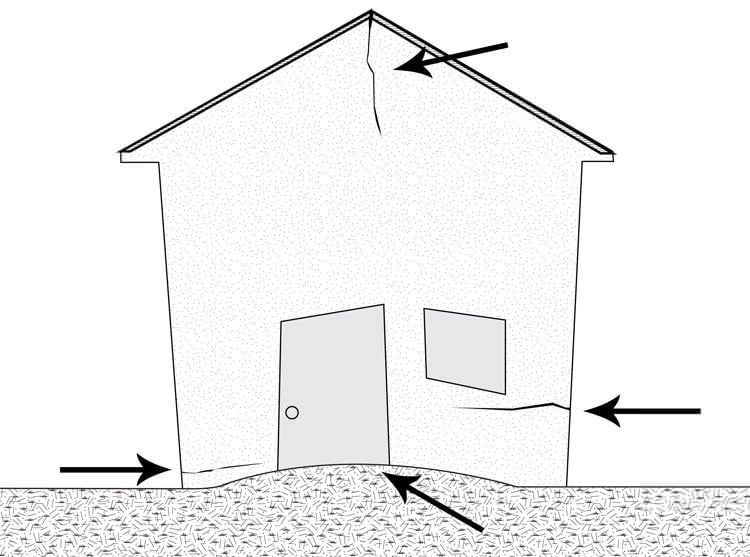

Absolutely! While it may seem tempting to skip the survey and save on costs, hiring a surveyor can save you from potential pitfalls in the long run. A comprehensive survey can unveil hidden defects that may not be immediately apparent, such as structural issues, damp problems, or hidden repairs, which could lead to expensive repairs down the line. By identifying these issues early on, you'll have a better understanding of the property's true value and can negotiate with the seller accordingly.

2. How much does a Level 2 survey cost?

The cost of a Level 2 survey, also known as a HomeBuyer Report, can vary depending on factors such as the property's size, location, and the surveyor's expertise. On average, a Level 2 survey in the UK can cost between £300 to £600. However, at [Your Surveying Company Name], we believe in transparency and simplicity. Our HomeBuyer Reports are offered on a fixed fee basis, with no extra charges for larger houses or additional rooms. Our competitive rate for a Level 2 survey is just £375 inc VAT, providing you with exceptional value for a comprehensive assessment of your prospective property.

3. How do I find a good surveyor near me?

Finding a reliable surveyor is crucial to obtaining an accurate assessment of the property's condition. Here are some steps to help you find the right surveyor:

a. Research and Recommendations: Start by researching surveyors in your local area. Look for professionals with experience in residential surveys, particularly those with good reviews from previous clients. Seek recommendations from friends, family, or your real estate agent, as they might have had positive experiences with surveyors they can recommend.

b. Credentials and Memberships: Ensure the surveyor you choose is a member of a reputable professional organization, such as the Royal Institution of Chartered Surveyors (RICS). Membership in such organizations signifies adherence to high professional standards.

c. Request Sample Reports: Ask potential surveyors for sample reports, so you can get an idea of how thorough their assessments are and whether they provide the information you need to make an informed decision.

d. Obtain Quotes: Contact a few surveyors and request quotes for the type of survey you require. While it's essential to consider costs, also focus on the level of detail and quality of service provided.

e. Check for Insurance: Ensure the surveyor holds professional indemnity insurance, which provides protection if any errors or omissions occur during the survey process.

Conclusion:

Choosing the right surveyor is a vital part of the property-buying journey in the UK. Investing in a surveyor can save you from potential headaches and financial burdens by providing you with a clear understanding of the property's condition. By following the tips outlined in this article, you can find a qualified surveyor near you, allowing you to make an informed decision and proceed with confidence on your path to homeownership.

For more detailed information and examples, you can also refer to the following link: [https://www.which.co.uk/money/mortgages-and-property/first-time-buyers/buying-a-home/house-surveys-aZOET4F4Fudj]

Home Surveys in Northwich, Middlewich & Winsford – What You Need to Know (and What They Should Cost)